Subprime Auto Loans: A Definition and Guide for Drivers

Buyers with low credit ratings or short credit histories might need to consider subprime auto loans to meet their transportation needs. Lenders are willing to be more flexible with qualifying applicants with lower credit scores or shorter credit histories in exchange for higher interest rates and longer loan terms.

Learn more about subprime loans to find out if this financing tool could help you reach your goals.

What Is a Subprime Auto Loan?

A subprime auto loan is a loan given to borrowers with low credit ratings or short credit histories. Lenders provide such loans, along with higher interest rates and fees, to make up for potential losses due to high default rates. Subprime loans are usually available for new cars or late-model used vehicles with less than 100,000 miles. Higher-value vehicles provide more collateral to back up the loan and have a better chance of being financed because they shield the lender from potential losses.

What Do Lenders Look For in Applications?

Creditors look at applicants' credit scores, length of credit history, and debt-to-income ratios. The most important factor is the credit score. This number varies from 300 to 850, with scores of 550 to 650 commonly classified as subprime. Lower scores fall deeper into the subprime category, with even higher interest rates.

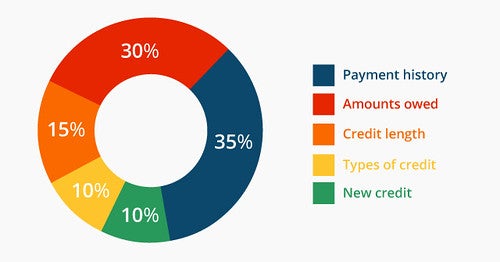

Credit scores are determined using formulas that take into account three main criteria:

- Payment history: Having the ability to make payments on time each month. A reliable payment history over several years is a definite plus to a credit report.

- Credit use: The amount of available credit used by the applicant. Increasing available credit boosts credit scores.

- Length of credit history: How long applicable accounts have been active. Keeping accounts active and current over time improves credit.

Three major credit bureaus provide credit scores to consumers and lenders: TransUnion, Experian, and Equifax. Consumers have access to their credit reports through the bureaus or other credit providers.

Debt-to-income ratios, or what you're paying out in debt service, ideally shouldn't exceed 50% of your income. Car payments and insurance usually shouldn't exceed 20% of the applicant's income. Companies review debt payments and budgeting for a car payment and insurance costs during the auto loan application process.

Our website at Tom Kadlec Kia has an auto loans page that offers free online applications for credit geared toward borrowers with all types of credit. You can also use our payment calculators to help plan your purchase.

How Do Borrowers Get the Best Rates for Subprime Loans?

Borrowers can take steps to improve their ability to secure a subprime auto loan with the best interest rates and terms for their situation. Subprime loans aren't all the same, as their rates and terms vary depending on factors that consumers can improve. Borrowers can take steps to improve their chances of being approved and getting the best rate for their situation.

Consider the following steps:

- Review your credit report, looking for any inaccurate information. It's possible to dispute and amend items on your credit report.

- Improve your chances of securing a favorable rate by paying bills on time and sending in more than just the minimum payments. If possible, save for a down payment on the vehicle that will reduce your loan size. Sometimes down payment matching promotions are available.

- Calculate potential costs of the new payment, including insurance, taxes, and other expenses. Determine your budget for a vehicle purchase while factoring in these associated costs. Be mindful that you might qualify for a larger loan than you can pay.

- Review the terms of the loan options, including the interest rate, payment amount, number of payments, and additional fees. Lower monthly payments could mean a longer loan with more interest paid over its lifetime. Also, compare the loan's length to the expected life span of potential vehicles. Many lenders will hesitate to give a loan that might outlive the vehicle.

- Consider delaying your vehicle purchase to give yourself time to clean up your credit report and pay down other debts. A higher credit rating will result in a lower-cost loan.

How Do I Check My Credit Score?

Checking your credit score doesn't hurt your credit rating. Instead, it can help you spot errors and establish improved financial habits that boost your rating. Lenders typically use one of the three credit bureaus listed above when considering granting credit to an applicant.

Credit bureaus collect and maintain credit history based on reports from lenders and creditors. Credit reports include personal information such as Social Security number, address, and employer. The reports list your creditors and information on payment history, account balances and limits, dates accounts were opened or closed, public records such as bankruptcies, and credit inquiries from lenders.

When you review your report, consider the following:

- Is your personal information accurate?

- Are the accounts and their histories listed correctly?

- Are any accounts listed as delinquent or in collections?

- If you spot any errors, contact the lender that incorrectly reported the error or the credit bureau that issued the report.

What Is the Best Place to Get a Subprime Loan?

Dealerships like Tom Kadlec Kia are more likely to find subprime loans with more favorable terms than traditional banks and lenders. Subprime loan lenders take on more risk with borrowers who have lower credit ratings and high debt-to-income ratios. Dealerships are familiar with subprime loans and how to find the best options for buyers.

With dealer financing, dealers send the applicant's information out to several lenders at once and look for the loan options with the best terms. This includes a hard credit check and a comprehensive review of your credit report. With direct loans, applicants get a preapproval and quote from one lender before shopping at the dealership, but this quote might not be a final offer.

Dealer financing provides more options and, especially for new cars, the potential for lower rates and better terms. At Tom Kadlec Kia, we offer online credit applications and are well-versed in providing subprime auto loans.

Regardless of your credit history, you can take steps toward getting approved for a car loan. Subprime auto loans are a financing tool that can help make a vehicle purchase possible.

Warranties include 10-year/100,000-mile powertrain and 5-year/60,000-mile basic. All warranties and roadside assistance are limited. See retailer for warranty details.

Warranties include 10-year/100,000-mile powertrain and 5-year/60,000-mile basic. All warranties and roadside assistance are limited. See retailer for warranty details.